On 18 September 2025, Ofcom formally opened the UK auction for over 5.4 GHz of millimetre-wave (mmWave) spectrum spanning the 26 GHz and 40 GHz frequency bands. This auction represents one of the most significant steps yet in the evolution of 5G in the UK—arguably the biggest spectrum release to date.

At present most mobile operators, including EE (BT), O2 (VMO2), Vodafone and Three UK, already have access to several 5G friendly mobile bands between 700MHz to 3.8GHz. Such spectrum reflects the same sort of bands that mobile operators have been harnessing since the advent of the first 3G and 4G data networks some years ago.

Ofcom Opens UK 5G mmWave Auction

Key Features of the Auction

-

Spectrum Release & Timing

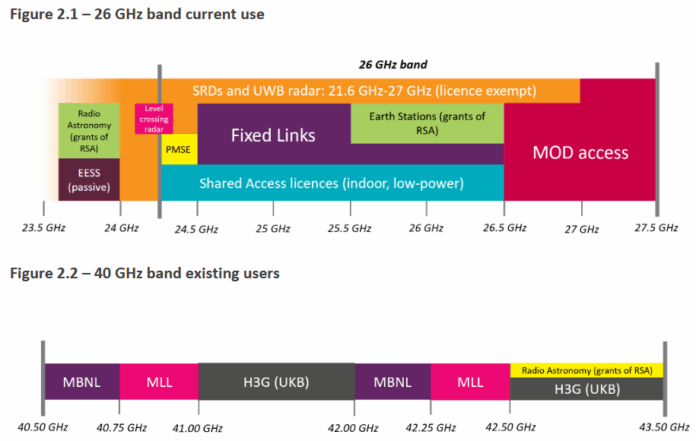

The release totals 5.4 GHz across the two bands. Licences apply specifically to High Density Areas (HDAs), of which there are 68 defined across the UK. Outside those zones—i.e. in Low Density Areas—spectrum access will be managed under a Shared Access regime, on a first-come, first-served basis. -

No Strict Roll-Out or Coverage Requirements

Unlike some previous spectrum awards, Ofcom is not imposing strict build-out or coverage obligations, nor “use it or lose it” mandates for these new licences. -

Coexistence with Existing Users

In the 26 GHz band, some fixed link operators remain active. Although these operators have been warned and are expected to vacate certain areas by 2028, until they are cleared there remains potential for interference and the need for careful coordination. -

Coordination Rules

Licensees must ensure that their radio equipment complies with Ofcom’s coordination procedures. This aims to manage interference and ensure smooth functioning among various users of the spectrum.

Challenges & Implications

-

Device Ecosystem

Globally, mmWave deployment has been slower in part due to limited device availability and maturity. The UK auction places it among the early adopters deploying mmWave at scale, which brings both opportunity and risk. -

Uncertainty in Lower Bands

Uncertainties around migration of lower bands—especially 26 GHz lower-band migration scheduled for 2029—add cost and planning risk for bidders and operators. -

Strategic Implications

Given the lack of hard obligations, licensees may proceed cautiously. Deployment strategies will need to account for coexistence issues, device readiness, business case strength, and regulatory coordination.

Benefit from Massive discount on our 5G Training with 5WorldPro.com

Start your 5G journey and obtain 5G certification

contact us: contact@5GWorldPro.com